Excitement About Simply Solar Illinois

Excitement About Simply Solar Illinois

Blog Article

Some Known Details About Simply Solar Illinois

Table of ContentsThe Best Strategy To Use For Simply Solar IllinoisThe Only Guide to Simply Solar IllinoisThe Ultimate Guide To Simply Solar IllinoisThe Single Strategy To Use For Simply Solar IllinoisThe Main Principles Of Simply Solar Illinois

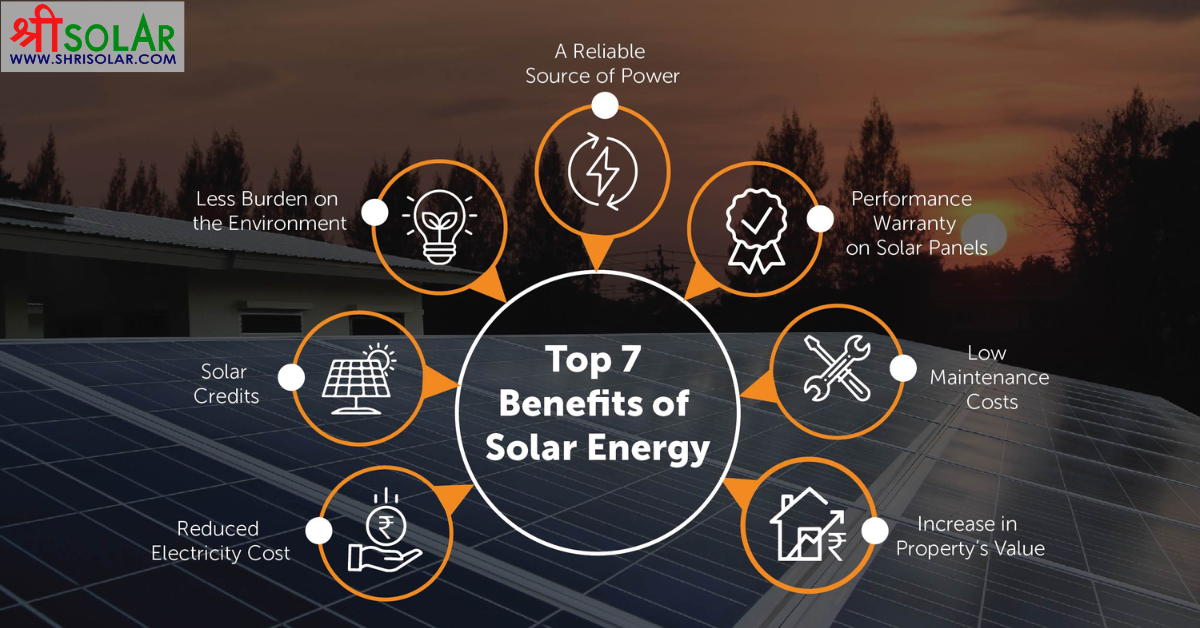

Our group companions with local communities throughout the Northeast and past to deliver tidy, budget friendly and reliable power to cultivate healthy and balanced communities and keep the lights on. A solar or storage space task delivers a number of benefits to the community it serves. As modern technology advances and the cost of solar and storage space decrease, the economic benefits of going solar remain to climb.Assistance for pollinator-friendly habitat Habitat repair on infected websites like brownfields and land fills Much needed shade for animals like lamb and poultry "Land financial" for future farming usage and dirt quality improvements Due to climate modification, severe climate is coming to be more constant and turbulent. Therefore, property owners, services, neighborhoods, and energies are all coming to be a growing number of interested in protecting energy supply services that supply resiliency and power safety.

Ecological sustainability is one more crucial motorist for organizations buying solar energy. Many business have durable sustainability objectives that include decreasing greenhouse gas emissions and utilizing much less resources to aid decrease their effect on the all-natural environment. There is an expanding urgency to attend to climate modification and the pressure from customers, is reaching the top degrees of organizations.

Top Guidelines Of Simply Solar Illinois

As we come close to 2025, the combination of solar panels in business projects is no longer simply an alternative yet a tactical need. This blogpost explores exactly how solar power works and the complex advantages it brings to commercial structures. Photovoltaic panel have actually been utilized on domestic structures for lots of years, yet it's just lately that they're ending up being a lot more usual in commercial building.

It can power illumination, home heating, cooling and water home heating in industrial buildings. The panels can be installed on rooftops, car park and side lawns. In this post we talk about how solar panels work and the advantages of making use of solar power in industrial structures. Electrical energy expenses in the united state are raising, making it more pricey for services to operate and more challenging to intend ahead.

The United State Energy Details Administration expects electric generation from solar to be the leading resource of growth in the united state power field through completion of 2025, with 79 GW of brand-new solar capability forecasted to find online over the following 2 years. In the EIA's Short-Term Power Expectation, the agency claimed it anticipates renewable energy's general share of electrical energy generation to rise to 26% by the end of 2025

What Does Simply Solar Illinois Mean?

The photovoltaic solar cell takes in solar radiation. The cords feed this DC electricity right into the solar inverter and convert it to rotating power (A/C).

There are numerous methods to keep solar power: When solar power is fed into an electrochemical battery, the chemical reaction on the battery elements maintains the solar energy. In a reverse response, the present departures from the battery my review here storage space for consumption. Thermal storage uses mediums such as molten salt or water to preserve and soak up the heat from the sun.

Solar panels dramatically decrease energy prices. While the preliminary investment can be high, overtime the price of installing solar panels is redeemed by the cash conserved on power expenses.

The 9-Minute Rule for Simply Solar Illinois

By setting up solar panels, a brand name shows that it appreciates the setting and is making an initiative to minimize its carbon impact. Buildings that depend totally on electrical grids are at risk to power outages that take place during bad weather condition or electrical Read Full Article system malfunctions. Solar panels mounted with battery systems allow industrial structures to remain to function during power failures.

Getting The Simply Solar Illinois To Work

Solar energy is among the cleanest kinds of energy. With durable service warranties and a manufacturing life of approximately 40-50 years, solar investments contribute significantly to ecological sustainability. This shift in the direction of cleaner energy resources can cause wider financial advantages, including reduced climate modification and environmental degradation prices. In 2024, property owners can gain from federal solar tax obligation motivations, permitting them to balance out almost one-third of the acquisition rate of a planetary system with a 30% tax obligation credit rating.

Report this page